|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Apply for FHA: A Comprehensive Guide for HomebuyersApplying for a Federal Housing Administration (FHA) loan can be a great step towards homeownership. FHA loans are popular due to their low down payment requirements and flexible credit criteria. This guide will help you navigate the application process. Understanding FHA LoansFHA loans are government-backed mortgages designed to make home buying more accessible. They are especially appealing to first-time buyers. Eligibility RequirementsCredit ScoreTo qualify for an FHA loan, you generally need a credit score of at least 580. However, a score between 500-579 may be accepted with a higher down payment. Down PaymentThe minimum down payment for an FHA loan is 3.5% of the purchase price, making it easier for those without significant savings. Steps to Apply for an FHA LoanGather Necessary Documentation

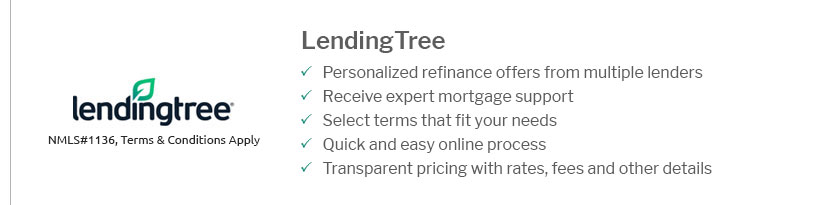

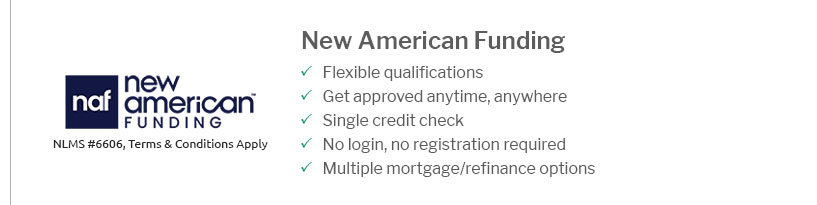

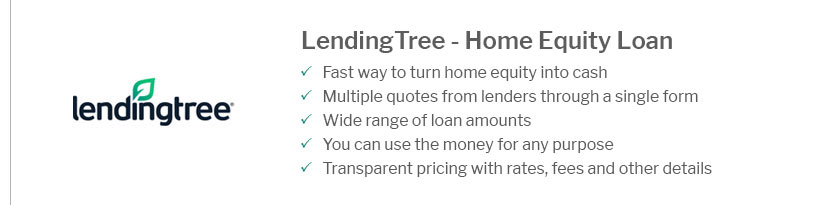

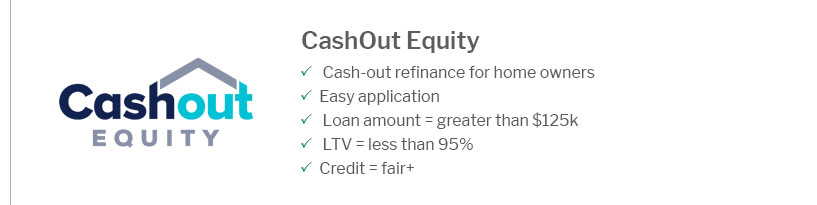

Find a LenderResearch the best home loan companies that offer FHA loans. It's crucial to choose a lender experienced with FHA guidelines. Pre-approval ProcessGetting instant mortgage pre approval can give you a competitive edge in the housing market. Complete the ApplicationWork with your chosen lender to complete the FHA loan application. Provide all requested documentation promptly to avoid delays. Things to ConsiderBefore applying, consider the following:

FAQWhat is the minimum credit score for an FHA loan?The minimum credit score for an FHA loan is 580 for most applicants. Scores between 500 and 579 may qualify with a higher down payment. How much is the down payment for an FHA loan?The down payment for an FHA loan is as low as 3.5% of the purchase price for those with a credit score of 580 or higher. Are there specific property requirements for FHA loans?Yes, the property must meet certain safety and livability standards to qualify for an FHA loan. https://m.youtube.com/watch?v=-xKvPezCqu4

Are you a first time home buyer interested in buying with a minimal down payment using FHA? This guide will breakdown the 2025 FHA Loan ... https://www.reddit.com/r/FirstTimeHomeBuyer/comments/18ky604/wanting_to_apply_for_fha_loan/

I want to apply for the FHA loan. My credit is good. I just don't know where to begin. Should i go through a bank or a mortgage company? https://www.hud.gov/federal_housing_administration/healthcare_facilities/section_242/how_to_get_started_steps_1_3

1. Self-Assessment. The first step is to perform a self-assessment to determine if FHA mortgage insurance is right for you. - 2. Choose a Lender - 3. Preliminary ...

|

|---|